IT’S TAX TIME!

We’ve been receiving questions from some of our clients since May as to when this will be available, and here it is. Our tax time 2023 individual tax return checklist and questionnaire.

Our clients will be receiving an email directly to share the exciting news, but, before we introduce it to you all, let’s touch on some important topics.

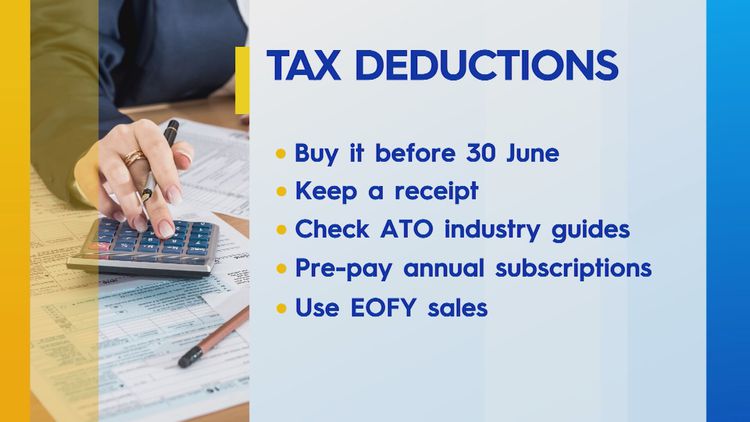

Record-keeping

To be able to claim a deduction, you must meet 3 key requirements:

- You must have spent the money, and not have been reimbursed for the expense

- The expense must be directly related to you earning your income (it cannot be a private expense)

- You must have a record of purchase (i.e. a receipt)

Don’t forget to let us know about your investments such as cryptocurrencies, shares, and property. The ATO have sophisticated data matching, so chances are, they know all about it.

Quick reminder: the ATO revised the work from home fixed rate method.

Fees and Billing

Contact us for more detail about this year’s fee structure.

Your responsibilities

You are reminded that you are responsible for providing accurate and complete financial information, including documentation to substantiate any deduction claimed. It is important to remember that you are personally responsible for the information contained in any statutory return and that you must retain all necessary supporting documentation to substantiate any claim. We will not take responsibility for any failure on your behalf to maintain to adequate records. You must also retain your taxation records for a minimum period 5 years from the date you lodge your return.